Don't Wait For Medical Emergencies To Deplete Your Savings! Be A Step Ahead with Schulze Law Group!

After decades of hard work, you've paid off your mortgage and built a retirement nest egg. But one health crisis could change everything! Let's say you get Alzheimer's and within two years, you'll need 24/7 care. What will happen to your life savings? Without proper planning, your entire life's savings could vanish quickly, leaving your family little to no money at all.

That's where understanding the terms, Medicaid, Medicare, and long-term care planning, becomes important. While these programs are confusing and the terms sound similar, they work very differently.

What Is Medicare?

Medicare is a federal health insurance for people over 65 or under 65 with a disability. It'll provide short-term care like hospital stays, rehabilitation, etc. But when Medicare insurance isn't enough for your daily needs, you can opt for Medicaid.

It's a joint federal and state program, covering your medical costs when you have limited income and resources. When both Medicaid and Medicare fail to cover your required costs, you can choose long-term care insurance to pay for your home care, assisted living, nursing, etc.

However, understanding the criteria, benefits of each program, and the whole process from application to approval can be daunting and complex. But our Medicare planning attorney in Reno, Nevada, at Schulze Law Group can assist you!

Are You Eligible for Medicare?

Besides being 65 or below that age with a disability, there's one other factor that can automatically make you eligible for Medicare facilities. It is when you have End-Stage Renal Disease (ESRD) or ALS (Lou Gehrig's disease).

If you want to start applying for Medicare facilities, you'll also need to know certain criteria about Social Security benefits. If you have already received the benefits since you were 62 or at least for 4 months before turning 65, then you'll automatically be enrolled in Medicare Part A and Part B at 65.

However, if you apply for Social Security only three months before turning 65 or even later, you can choose to sign up for Medicare and Social Security benefits simultaneously. However, if you're 65 and working, applying for Medicare is your only option. You can also choose to wait till your retirement and sign up when a special enrollment period starts for Medicare facilities.

You can take help from our Medicare planning lawyer in Reno, Nevada, for more clarity about these eligibility criteria. We'll guide you every step of the way, ensuring you don't face any delays or obstacles in getting Medicare benefits.

Traditional Medicare Does Not Cover Assisted Living

-

What is Assisted Living?

Assisted living facilities support older adults with daily living while fostering their independence. Individuals who do not require round-the-clock nursing but need help with everyday activities like bathing, housekeeping, medications, and meal preparation can benefit from assisted living.

Some seniors choose to move into assisted living following a frightening event, such as a fall. They want to live autonomously but may feel unsafe in their homes.

-

Understanding the Coverage of the Medicare Program

Averaging $4,500 per month, assisted living can be expensive. Those considering assisted living might wonder whether Medicare, a federal health insurance program for qualifying adults aged 65 or over, will cover the cost.

Traditional Medicare covers only certain health services for those residing in an assisted living facility. Meanwhile, some Medicare Advantage programs may only pay for services that help people remain in their homes.

While traditional Medicare supports older adults' medical needs, it does not apply to most assisted living expenses. Assisted living facilities help residents with everyday, non-medical tasks, which Medicare typically does not include.

-

What Does Medicare Cover?

Expenses Medicare may cover include:

Breakdown of Medicare Parts

Medicare has four parts, A, B, C, and D. Let's understand each of them in detail.

- Medicare Part A insures people for hospital stays and up to 100 days in a skilled nursing facility. Skilled nursing facilities provide 24/7, short-term nursing care. Because they deliver medical care, they are distinct from assisted living facilities, which offer custodial or daily living care.

- Medicare Part B pays for medical fees for outpatient care. To get this benefit, you'll either have to be a U.S. resident and citizen or a legal permanent resident living in America for 5+ continuous years.

- Part C is a type of Medicare that certain insurance companies often provide. Besides the usual Medicare benefits, Part C also provides for additional advantages like dental, vision, and hearing care.

- Part D covers prescription drug costs. This part is optional and is offered to everyone with Medicare by insurance companies.

Most assisted living expenses do not fall under Medicare Part A, B, or D. However, traditional Medicare may cover specific medical costs for people in assisted living. If you need more information, you can contact our Medicare planning attorney in Reno, Nevada.

Does Medicare Advantage Pay for Assisted Living?

Private insurance companies that contract with traditional Medicare sell Medicare Advantage plans. Like original Medicare, these plans typically do not cover monthly assisted living bills.

Certain Medicare Advantage plans may offer supplemental home care benefits that help people continue living independently, albeit in their own homes rather than a designated facility.

The services available through select Medicare Advantage programs may include home modifications like wheelchair ramps and bathroom safety grab bars; in-home assistance with daily tasks; and transportation to the hospital and the pharmacy. Adult daycare is also available through some Medicare Advantage plans.

Seniors looking to live on their own might consider enrolling in a plan that includes services that support autonomy. Many programs are available, and the coverage that is open to you depends on where you live. The terms of Medicare Advantage plans vary. Review your plan options and speak with our Medicare planning lawyer in Reno, Nevada, before deciding whether to enroll in a Medicare Advantage program.

Does Medicaid Pay for Assisted Living?

Unlike Medicare, Medicaid generally will pay for some of the costs of assisted living. Medicaid is a joint federal-state health insurance program for low-income people, including older adults. Although it does not cover room and board for assisted living, it may help pay for personal care services, on-site therapy services, and medication management.

However, Medicare can offer broader provider options, and the coverage will be the same regardless of the state in America where you live.

Before deciding whether to move into an assisted living facility, schedule a meeting with our Medicare planning lawyer in Reno, Nevada.

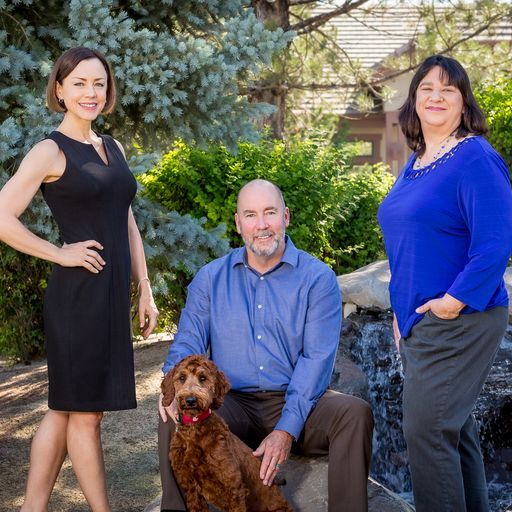

Richard Schulze can advocate for you and help you plan for the future.

Stop Guessing About Medicare! Get Expert Advice From Our Lawyers at Schulze Law Group!

With more than 25 years of experience, Schulze Law Group has been serving customers in Nevada with expert legal advice. We are skilled professionals with deep knowledge about the local law system. We know how to care for our clients and give them the peace of mind they desire by customizing plans as per their specific needs.

If you want Medicare planning in Reno, Nevada, we're here to give you the guidance and support you need. We have loyal clients who trust us to take care of all their estate, long-term care planning, and Medicare and Medicaid planning.

Trust us to do the same for you, too! Call us now at (775) 853-5700.